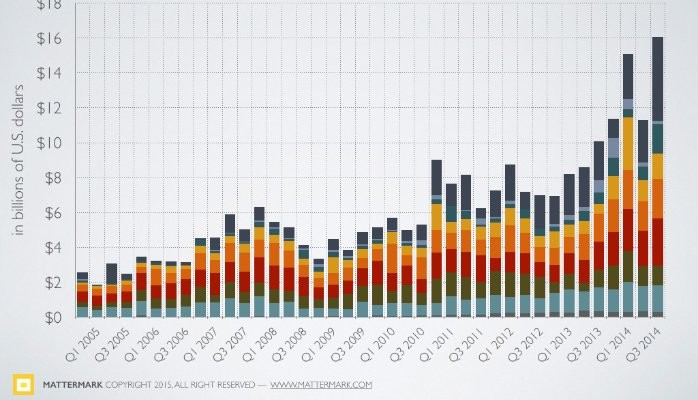

Q4 2014 Startup Investment at Highest Point In 10 Years

This analysis shares early results from “Startup Funding: Historical Analysis 2005–2014″ and you can pre-order the full report for just $5 or pay-what-you-want. On February 2nd we will release the full report, including geographical, industry, and portfolio analysis.

As the research and analysis process for this funding report continues, I find it fascinating to observe the concentration of capital around later stage deals. While discussion of deal volume and bubbly valuations at the early stage is a popular topic of conversation, it is the late stage mega-rounds that have been driving up total dollars invested into startups over the past 3 quarters.

In the fourth quarter of 2014, 11 startups received funding in 12 mega-deals reported to be $100M or more, totaling $4 Billion dollars. Rather than rank them by deal size, this list is ordered by their Mattermark Growth Scores. You can sign in to your Mattermark Professional account or start your 15 day free trial today to explore the underlying metrics.

Mega-Rounds > $100M in Q4 2014

- $165M to Houzz (Series D)

- $1.8 Billion to Uber (Series E and Private Equity respectively)

- $120M to Slack (Series D)

- $220M to Instacart (Series C)

- $150M to Square (Series E)

- $100M to Mirantis (Series B)

- $542M to Magic Leap (Series B)

- $335M to WeWork (Private Equity)

- $185M to Mozido (Series B)

- $100M to Revel Systems (Series C)

- $250M to SurveyMonkey (Private Equity)

If you found this analysis interesting please consider pre-ordering the Startup Funding Report — it’s just $5 for the first 500 orders and the price will increase through the month until we release it at full price.

This in-depth analysis will look at data behind trends like the rise of seed rounds that look like Series As, introduction of micro VC and proliferation of the startup incubator/accelerator model, massive private equity deals replacing IPOs, the changes in timing between rounds, round sizes, geographical distribution of investment and much more.

We will also explore the survival, exit and death rates of startups in different regions, industries and specific investor portfolios.

Methodology Notes

This report includes only funding rounds in private companies in the United States. Additionally, it excludes funding in pharmaceuticals, biotechnology, energy and clean technology companies.

Coaching Psychologist & Career Strategist | Speaker | Mindfulness Meditation Shepherd | Follow Me For Daily Mindset Insights

9yTony Xhufi - I would think this will be of interest to you?

Portfolio Manager @ Arrowroot Family Office

9yAlso, including a huge company like Uber greatly skews your statistics. If the estimated Mkt Cap of Uber is 20 Billion, it should not be listed as a startup. Take this off and you have a CRASH!!

Pioneer in Chat, AI and TeleDental | Dental Chat | Teledental.com | Technology Innovator | Dentist | Investor | DentalChat.com | Speaker | Helping dentists connect to new and existing patients.

9yLot of capital going towards new tech and game changing companies. Most of these, it seems will be going towards an IPO after raising so much capital.

The A-to-Z Homebuyer Direct's Listing

9yThe nation as a whole must invest in areas that promise long-term growth and innovation. To improve our economic fortunes we need robust innovation strategies in order to compete in the hyper-competitive ‘New Economy.’

Professional Voice Actor/Photographer/Editor looking to create the content you need to succeed!

9yThen how come all these "buy gold and silver" adverts on major television networks from #LearCapital and other outlets?? #DollarDevalued