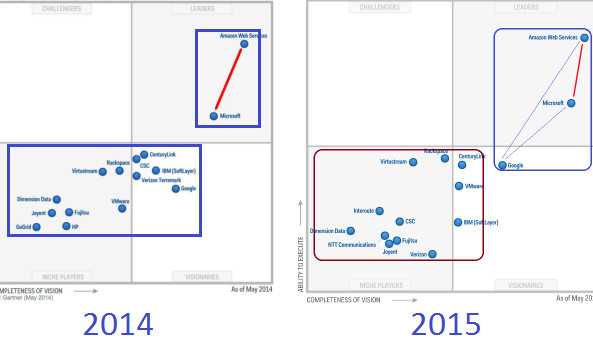

AWS, Microsoft Azure & Google in Gartner Magic Quadrant for IaaS 2015

Note: Observations are personal and do not represent views of current or past employers, associations or organizations unless otherwise stated.

In June 2014, I had written about how the IaaS market leader, Amazon Web Services (AWS), followed closely by Microsoft Azure and IBM SoftLayer are stacking up against each other with a host of other vendor platforms in the highly followed and contested Infrastructure-as-a-Services (IaaS) domain. The 2015 Gartner Magic Quadrant for Cloud IaaS is out. One of the key things we see included in this year's report is a classification of Mode1 and Mode2 type of workloads.

According to Gartner,

Most of the providers are oriented toward the needs of Mode 1 traditional IT, especially IT operations organizations, with an emphasis on control, governance and security; many such providers have a "rented virtualization" orientation, and are capable of running both new and legacy applications, but are unlikely to provide transformational benefits. A much smaller number of providers are oriented toward the needs of Mode 2 agile IT; these providers typically emphasize capabilities for new applications and a DevOps orientation, but are also capable of running legacy applications and being managed in a traditional fashion.

This is an extremely significant point to note for CIOs of organizations looking for adding Agility, Transformational Ability added with a CapEx to OpEx change. Hence whilst considering an IaaS provider, referring to both Mode1 and Mode2 specialization offerings from all vendors is deemed necessary.

Few key observations include - AWS continuing to innovate and fulfilling its completeness of vision. Being extremely agile, it adds features coupled with price cuts regularly. In 2013, Microsoft Azure had vision but was poor in execution (as per Gartner). The 2 leaders in the Cloud IaaS were: AWS & CSC.

2014: It has changed quite a bit in 2014. IBM had finished its SoftLayer acquisition. AWS added more features and price types & cuts and Microsoft Azure went from a general availability (GA) of IaaS in April 2013 - from a nascent IaaS stage to adding more features, capabilities and adding Open Source to run non-Windows workloads on Azure as well. In 2014, the 2 leaders in the Cloud IaaS segment included: AWS & Microsoft Azure.

While all this happening, Goolge cloud was coming to fruition.

2015: In 2015, we see AWS as the clear IaaS leader, with Microsoft closing the gap even further. Microsoft's strength lies in its ability to offer all 3 - Private Cloud (Hyper-V on Windows Server 2012 & R2), Hybrid Cloud (Hyper-V, System Center 2012 & Microsoft Azure) and Public Cloud (Microsoft Azure). But as Gartner rightly says, Microsoft needs to diversify and add more non-Microsoft and non-Windows workloads (especially attracting the do-it-yourself folks) from the Open Source (which personally, I feel has been the focus for Microsoft globally) and is in the right direction. While all this was going on, as I had reiterated in my 2014 post, one should *NOT* forget Google.

According to Gartner in its 2015 report,

Google Cloud Platform combines an IaaS offering (Compute Engine), an aPaaS offering (App Engine) and a range of complementary services, including object storage and a Docker container service (Container Engine). Google's strategy for Google Cloud Platform centers on the concept of allowing other organizations to "run like Google" by taking Google's highly innovative internal technology capabilities and exposing them as services that other companies can purchase. Consequently, although Google is a late entrant to the IaaS market, it is primarily productizing existing capabilities, rather than having to engineer those capabilities from scratch.

One thing is evident, we can group all the vendors in a pack of 2. Leaders versus laggards. Leaders definitely will include AWS, Microsoft Azure and I would also include Google. On the other hand, all the rest vendors can be grouped into "laggards" with either no clear strategy of execution, or coupled with poor vision to add new features, no clear integration of existing PaaS with IaaS capabilities, limited number of API exposure, poor Partner/SI ecosystem and more importantly, poor agility when it comes to changing present scenarios.

If we do a side-by-side comparison for 2013, 2014 and 2015 Gartner Magic Quadrant for Cloud IaaS, we get:

There are 3 key observations:

- AWS has continued to be Cloud IaaS leader owing to its sheer force of continued investments in engineering, adding new features, adding additional capabilities to existing features and more importantly, taking a fanatical approach to customers & their needs. The Partner eco-system is rich and varied, and its highly likely, you will find an already existing AMI for any workload App you could dream of in any industry.

- Microsoft has successfully shed off its non-agile, Enterprise-only, Microsoft-stack-only image. Starting with PaaS and GA of IaaS in April 2013, this has been a revelation for Microsoft. Adding new features, and functionality to Azure; Microsoft is now gaining serious traction in the IaaS space in all domains - startups, SMBs, Mid-market accounts and Enterprises (which have always been a stronghold for Microsoft in the CAM-S/E and EPG segments). What Microsoft needs to do more is focus on its existing Developer community, adding more developers (both individuals & ISVs) who will build more cross-platform (Microsoft & Open-Source-based) tools, third-party apps and products to run on Azure and thus enrich the Partner & customer eco-system which Microsoft needs right now.

- Most importantly, both AWS and Microsoft will get serious competition from Google in forth-coming summers to come. Google may not compete in Mode1 workloads as of now, but definitely Mode2 is where their strength lies in. Both Google PaaS and IaaS offerings will mature in days to come and they will compete with both AWS & Microsoft in terms of adding new features, updating existing feature sets and competitive price cuts as well. As rightly put by Gartner, the Partner (SI) eco-system is nascent and Google needs to put in considerable effort in building engineering, sales, business development & account managers globally; which are one of the key strengths for both industry leaders - AWS & Microsoft globally.

Read the section 'Vendor Strengths and Cautions' in the Magic Quadrant for Cloud Infrastructure as a Service, for a detailed analysis across AWS, Microsoft Azure & Google from Gartner.

About Subhasish:

Am a VP - Business Development & Alliances at 8KMiles Software Services Inc. 8KMiles (BSE:512161, NSE:8KMILES) based in San Francisco is a premier Cloud Consulting, Advanced DevOps, Security-focused IP-led Enterprise Solutions & Managed Services provider globally. An Amazon Web Services (AWS) Premier Consulting Partner (2012-2013) & Microsoft Azure Circle Partner, 8KMiles collaborates with Mid-Market & Large Enterprises across Pharma, Health Services, Life Sciences, Education, Retail & State/Central Gov agencies to provide innovative security-based Cloud Solutions across both platforms: AWS & Azure. Am reachable on subhasish.g@8kmiles.com / +1-(925)-6598023 / +91-9884839161

Highly Experienced Software Architect

8yThis is a true picture of a true focus. Helps position the Windows 10 desktop in the right context: Windows (10) is not in the (true) focus. Get over it.

Very good analysis. Given Magic quadrant is on completeness of vision; what constitutes this vision? It would be interesting to see how much is overlap and indignity in the constituents of the vision each provider driving. Are providers in lower quadrants, leading any of the constituents which are more futuristic/disruptive?

Technology Strategy | Enterprise Architecture | Innovation | Engineering | Digital Transformation

8yNotably, mode 2 has a different approach to transaction processing and ACIDity management