A Promising Start to 2015

Since last year ended on such a strong note, many of us were optimistic about the prospects for Q1.Though not as strong as the fourth quarter of 2014, the first quarter of 2015 kicked off on a positive note, with 23 technology companies raising US$6.1 billion. That’s the second highest first quarter proceeds in the past five years and impressive given the increased US market volatility and consistent with the high pre-IPO valuations we’ve seen recently. Looking at the year over year comparison, offerings were down 12% and proceeds declined 11%. Still, it’s a promising start for 2015.

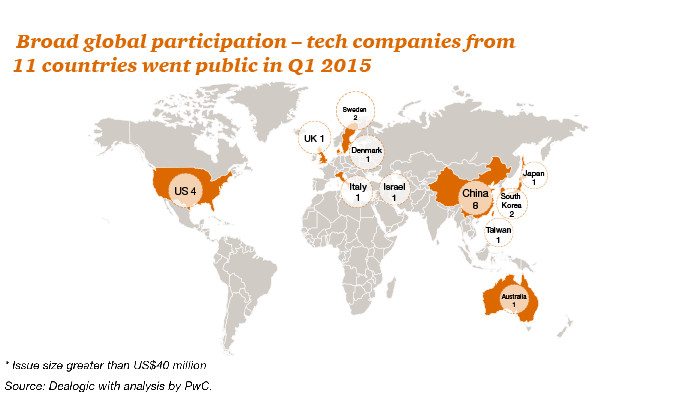

Global participation in the technology IPO market remained strong in the first quarter with 11 countries represented, on par with the prior quarter and a significant improvement from the four countries of a year ago. China and its exchanges made a strong showing, posting the most tech IPOs (8) and raising US$1.1 billion, all on Chinese exchanges.

Even Europe, with uneven tech IPO activity the past year, had five tech IPOs, including the largest of the quarter, raising US$2.4 billion. Total proceeds raised across European companies were $US3.0 billion.

The US had just four tech IPOs, raising US$1.4 billion, a decline in both proceeds and number of IPOs from both Q4 2014 and Q1 2014. Higher volatility of the US capital markets combined with easy access to venture capital at record high pre-IPO valuations were the principal factors behind this lackluster showing.

Additional information is available in the detailed report which can be viewed and downloaded from http://www.pwc.com/globaltechipo.

Raman Chitkara leads the global technology practice at PwC. He has more than 30 years of experience working in the technology industry in the Silicon Valley. His clients have included technology companies with global operations ranging from start-ups to multibillion-dollar multinationals in semiconductor, software, internet, computing and networking sectors. Read Raman Chitkara’s full biography.

Consultant: ▪Stakeholder Engagement ▪Diaspora Enterprise ▪Business Development

8yThis is quite interesting!! It would also be interesting, particularly for potential investors, to also get insights into other emerging markets, specifically the African continent to capture a sense of the growth potential and further opportunities in that region