Want to Change the World? Don’t Neglect Your Personal Finances

In this series, professionals share what they'd do differently — and keep the same. Follow the stories here and write your own (please use #IfIWere22 in your post).

At 22, the world is your oyster. The possibilities seem endless, and you’re eager to make an impact on the world. Here are my four top tips for how to go about it.

1. Develop – or continue developing – your human capital. It’s the key to your success.

Don’t listen to those who question whether a college degree is “worth it” anymore. The student debt challenge is serious, but it has not made a college degree any less relevant. Consider that the unemployment rate for people with a bachelor’s degree or higher is nearly half that of people with just a high school diploma. Moreover, jobs requiring a graduate or professional degree will grow faster than all other jobs through 2020 – so don’t be deterred from pursuing a graduate degree if your research tells you it’s a wise investment. (If you need help in making a cost/benefit determination, check out gradsense.org.)

2. Even when you have a diploma in hand, commit to being a lifelong learner.

To thrive in this time of rapid change, you must never stop learning and growing. But that doesn’t mean you have to be in a classroom forever. It’s more about the state of mind you bring to your work.

When you start a new job, see yourself as a student of the organization. Immerse yourself in the details, ask questions, and raise your hand for assignments that will expand your knowledge. Work hard to develop an expertise about the organization, its history, its challenges, its people, and its directions. Learn about your competitors and the wider industry you’re in. That kind of broad knowledge will enable you to make an impact on your organization – and advance in your career.

3. Think of your career path more like a climbing wall than a traditional “career ladder.”

Sometimes you need to go sideways to make progress. You may even have to move down the wall at certain points. The key is to keep growing and learning.

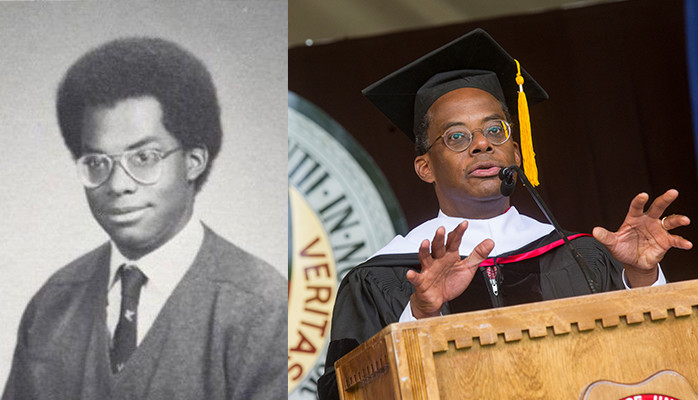

My career path has been anything but straight. I started out practicing law, and then joined the consulting world for 13 highly rewarding years. When I had the opportunity to serve as a governor on the Federal Reserve, I did not hesitate to accept. Since 2008, I have had the good fortune to lead TIAA-CREF. I have loved applying my talents to such a diverse array of positions and organizations. It’s been extremely rewarding on both a personal and professional level. But if I had started out with rigid notions about getting from point A to point B in my career, I would have missed out on many opportunities that have enriched my life.

4. Give your financial life the same kind of focus you give your work and social lives.

Your goal should be to achieve financial well-being, because without it, you’ll have a tough time making any kind of impact on the world. You can’t change the world if you’re worried about being able to make the monthly payments on your student loan.

Financial well-being is not about the size of your paycheck; it’s about having a clear vision for the future and confidence in your ability to get there. It requires a healthy dose of “financial literacy” – understanding the concepts of personal finance, knowing how to use credit wisely, and having a long-term financial plan. To boost your knowledge, take a look at startingout.tiaa-cref.org – a financial education site that TIAA-CREF developed to help young people build financial well-being.

To be sure, today’s 22-year-olds face some unique financial challenges, including student debt levels topping $1.2 trillion. But you can face any challenge and thrive with careful planning. Make sure that when you enter the working world, you have long-term financial goals, even as you deal with short-term goals like buying a car or taking a vacation. Most important, start saving when you’re young – because saving even a little bit on a regular basis can have a huge effect on your financial well-being. And if you truly want to make an impact, that’s probably the best advice of all.

Retired August 2023 -Assistant Vice President Human Resources

8yThanks for this concise, simple post that I've just sent to my FB for nieces, nephews, and children of my first cousins who are all now coming into their own. Wisdom is there for the giving, but as a wise woman I know that at this age (20s-30s) they'll listen to others before they'll listen to family. I plan to save this for when my high schoolers get to that point.

--

8ySuch a brilliant and wise man!

FP&A

8yA combination of #2 and #4 is something I try to tell all my friends and colleagues: It's never too late to learn about managing your personal finances!