Outlook for Vietnam Stocks in 2015

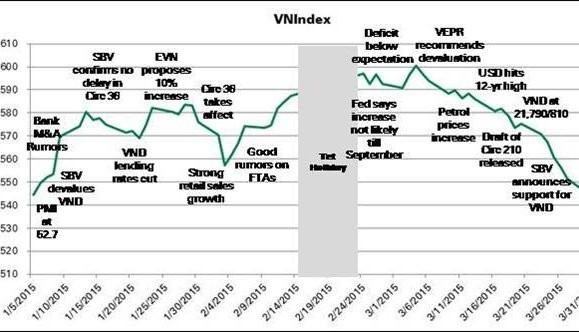

Last quarter, we predicted that the VN-Index could rise to 660 to 680 during 2015. We also predicted that much of the gains would be realized in the first quarter, with an index level of 630 to 650 being likely. Then as we drew closer to interest rate hikes by the Fed and higher inflation from school fees during Q3/2015, the index would be likely to slow. Because the first quarter failed to meet our expectations and because we are drawing closer to the events we predicted for the third quarter, we now adjust our forecast to 600 to 620 for Q2 and 630 to 650 for the year.

Regulatory developments may have a continuing negative effect on stocks in the short-term but are good for long-term health. Circular 36 significantly impacted P/E ratios in Q4/2014 and Q1/2015 but its impacts have now been built into prices. For Q2 and Q3, amendments to Circular 210 will lead to lower liquidity in the stock market and lower valuations by regulating the amount and sources of borrowing and use of capital by securities companies. Decree 34 may be good for the banking system in the long term by giving VAMC more power to purchase and resolve NPLs, but it is unlikely we will see any impact in Q2.

Historically, there has been a strong negative correlation (82.7 percent) between the risk-free rate (the five-year government bond yield) and the VN-Index P/E ratio. However, this relationship did not hold true during September and October of 2014 as the two measures moved downward together. In 2015, the correlation appears to have been reestablished at the lower P/E ratio. With the return of moderate inflation we expect bond yields to rise slightly, so this ratio would indicate that P/E ratios would stay flat near the 12x range, but that may not be the case, as we will discuss below.

In spite of the expected continuation of foreign selling, we believe that Vietnamese stocks have been oversold. We performed a comparative analysis of neighboring ASEAN emerging markets to assess the market conditions. Compared to Thailand, Indonesia, and Philippines, Vietnam’s valuations have been more severely impacted by global capital flows.

At the close of the quarter, the VN-Index was trading at 12.4x P/E while Bangkok, Jakarta, and Philippines were trading at 19.8, 22.1, and 21.9, respectively. They have traded at a premium to Vietnam for quite some time but the gap has widened and is not justified by ROE, ROA, or risk-free rate measures. Only relative size and liquidity justifies the premium, but this is not new. We therefore believe that a return to P/Es in the range of 14x would be more appropriate.

_________________________________________________________

This is an excerpt from our Market Outlook Report. To download the full report, please click here.

Institutional business department at BaoViet Securities

8yThanks Barry, our chart seems really good !!!

Knowing nothing

8yROE is highest but why having no attraction to Foreign Investors? And why the P/E so low compared with neighboring markets? Exchange rate VND/USD is expected stable in this year but what happens with others? USD based investors might be okie but JPY and EUR ones might not! Could you have an outlook for other major currencies?

Cпециалист по азиатским развивающимся рынкам и альтернативным инвестициам

8yHave inflation figures become that low? (table)